The recent economic data presents a nuanced narrative, showcasing the resilience of the US economy amid uncertainties. As we navigate through the mixed signals of GDP growth, price index fluctuations, and surprising jobless claims, it becomes evident that a comprehensive understanding of these indicators is essential for making informed predictions about the nation's economic trajectory. The upcoming release of the PCE Price Index will serve as a crucial piece in the puzzle, providing a more complete picture of the economic landscape and shaping expectations for the months ahead.

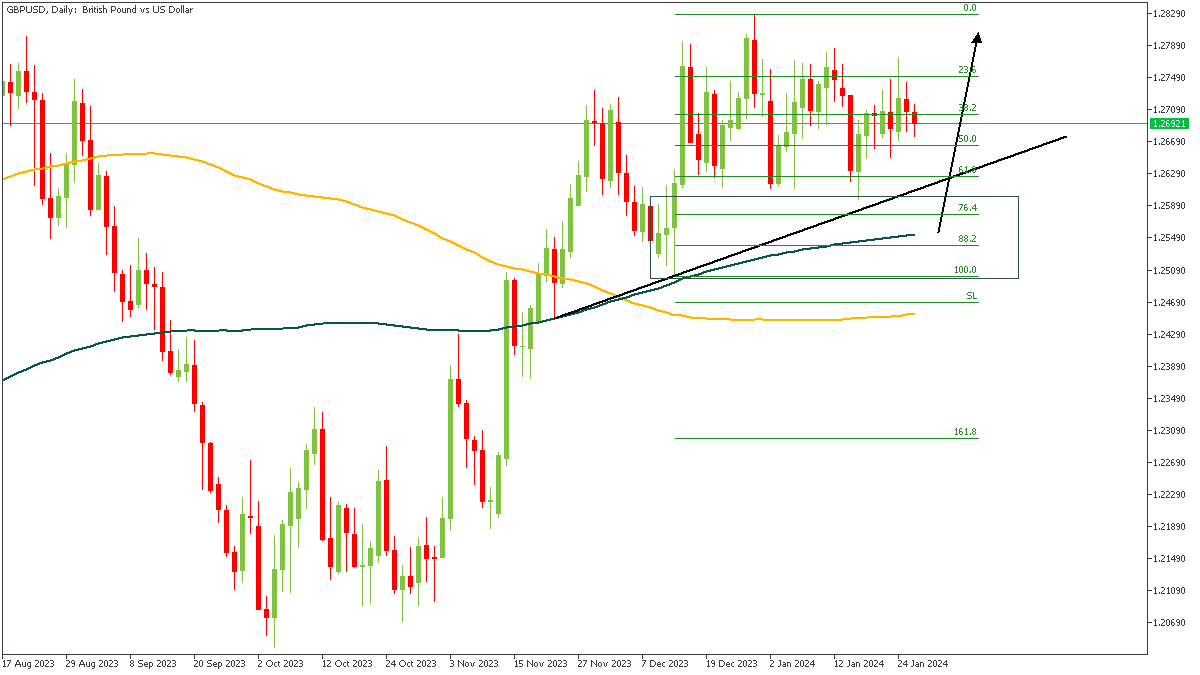

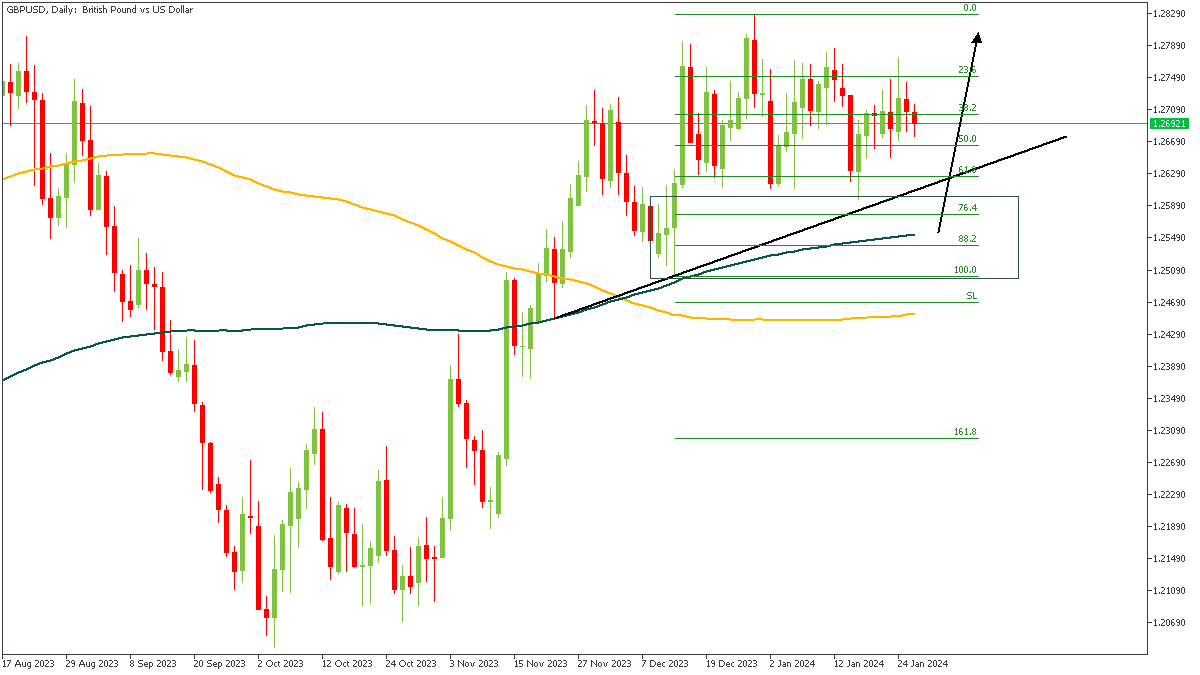

GBPUSD - D1 Timeframe

The Daily timeframe of GBPUSD looks quite choppy, but the price action indicates that the last major break-of-structure was a bullish break, hence, I have positioned my entry at the drop-base-rally order block. This order block syncs well with the bullish array of the moving averages, the 100-day moving average support, 76% of the Fibonacci, as well as the trendline support. All these suggest the likelihood of a bullish outcome soon.

Analyst’s Expectations:

Direction: Bullish

Target: 1.26988

Invalidation: 1.24922

EURUSD - D1 Timeframe

EURUSD is currently resting on the support trendline, and the 76% of the Fibonacci retracement level. The presence of the 200-day moving average as a support, and the 88% of the Fibonacci retracement right on top of the drop-base-rally demand zone concludes my argument in favour of a bullish outcome.

Analyst’s Expectations:

Direction: Bullish

Target: 1.09300

Invalidation:1.07191

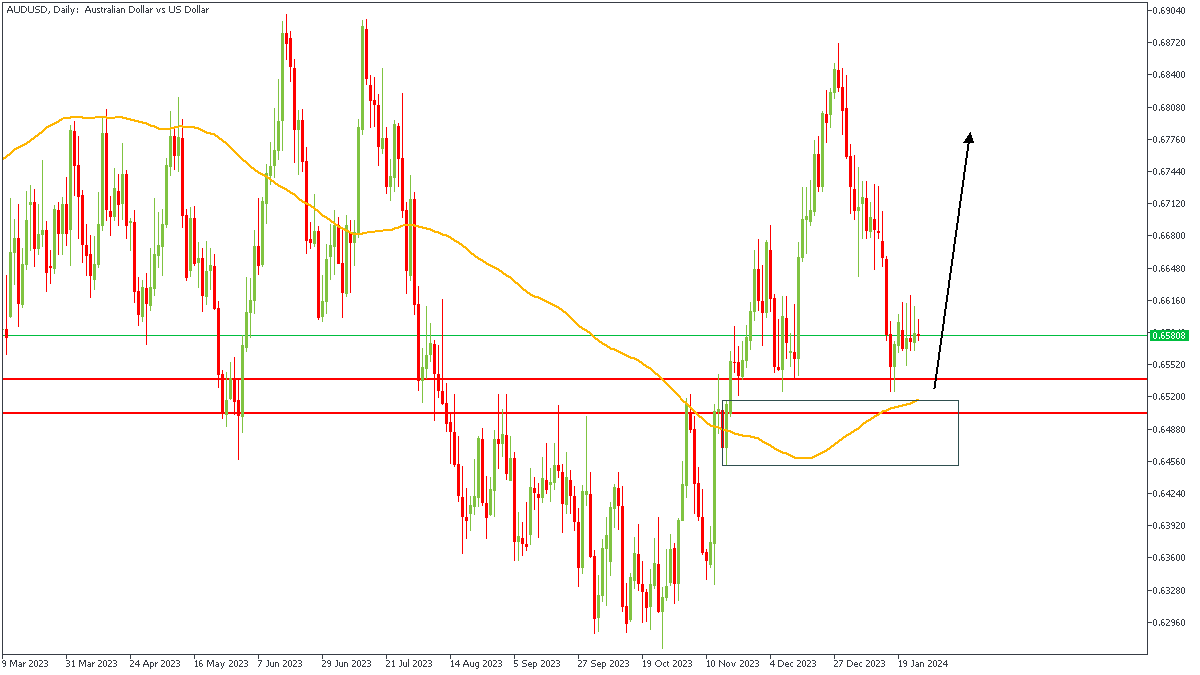

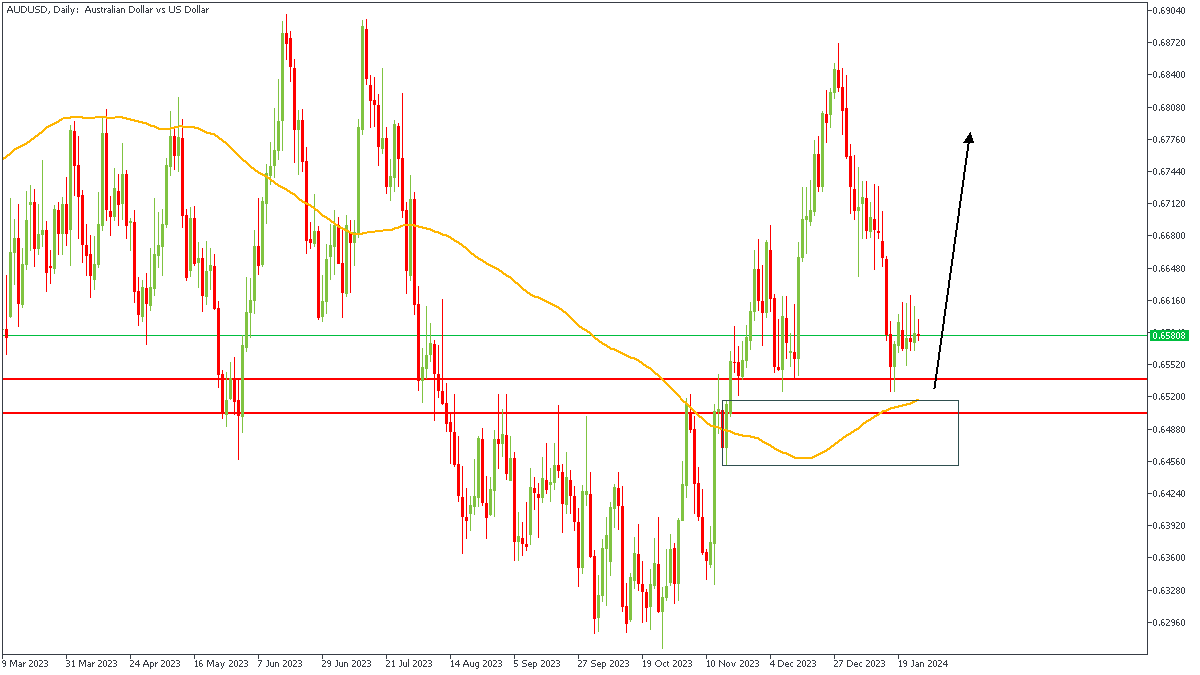

AUDUSD - D1 Timeframe

AUDUSD had quite a swift drop for a couple of days and can be seen consolidating at the moment; this price action is often indicative of the weaning off of the bearish impulse, creating room for new buying pressure. Furthermore, the rally-base-rally demand zone, pivot zone, and the 200-day moving average all seem to agree in favour of a bullish reaction from the marked zone.

Analyst’s Expectations:

Direction: Bullish

Target: 0.66395

Invalidation: 0.64453

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.