Psychology Of A Trader: What To Do If Profits Do Not Grow Regularly?

The mental stability of a trader is a crucial factor in the decision-making process and profit growth. This article maps out the meaning of trading psychology, the most common trading mental issues, and advice on overcoming them and thinking as a winning trader.

Trading psychology

Trading psychology is a combination of traders’ reactions to all the market events and other factors which affect trading. It is the psychological condition of a trader that determines his trading decisions and trading career improvement at large. As practice shows, it is not a high intelligence that is needed to achieve success, but psychological factors such as patience, perseverance, discipline, and a healthy state of mind.

Traders can take the same situation differently. For instance, with a sharp stock price drop, some start to panic and sell off the assets, while others prefer to buy these stocks at a low price, being confident that the price will rise again. Thus, there are various psychological types of traders:

- Impulsive traders perform without a well-thought-out plan. They make decisions fast, disregarding consequences, so being subjected to emotional trading with potentially significant losses.

- Careful traders comprehensively analyze a market situation and their financial position before hopping into the trade. This type of trader is usually emotionally stable and has a good self-management plan in place. However, sometimes they lack acting risky, which might be profitable.

- Practical traders are both risk-takers and careful traders. They know all about risk management and act confidently in their trading.

You probably recognized yourself in one of the traders’ psychological types and can slightly reflect on the connection between this type and your trading results.

No doubt, trading psychology is a crucial element. Only total control of the trader’s actions leads to stable returns preventing occasional profitability and losses. However, not every trader can control their emotions and keep a positive attitude. So, next, let’s talk about the trading psychological issues that harm your job and don’t allow you to have stable returns.

Why don’t profits grow regularly, or the psychological issues in trading

All traders are different, but the psychological issues are the same because we are all human beings with a certain structure of the body and its nervous system. We all live in society and obey its laws. That's why we can highlight the most common mental issues in trading and answer why profits do not grow regularly.

Random reinforcement

Sometimes amateur traders find themselves in a pyridoxal winning streak, while seasoned traders suffer from several failures in a row. Despite such situations being a game of luck, these traders start to believe in their skillfulness or vice versa, falling into a trap of random reinforcement.

Random reinforcement is a destructive psychological phenomenon that is widespread among traders. Random reinforcement creates a trader's misconception about his capabilities clouding the trader's mind and giving rise to overconfidence, or otherwise, an extreme lack of self-confidence. The thing is, newbies may decide they found an easy way to make a profit, while professionals may doubt their skills, trading plan, and their trading knowledge at large.

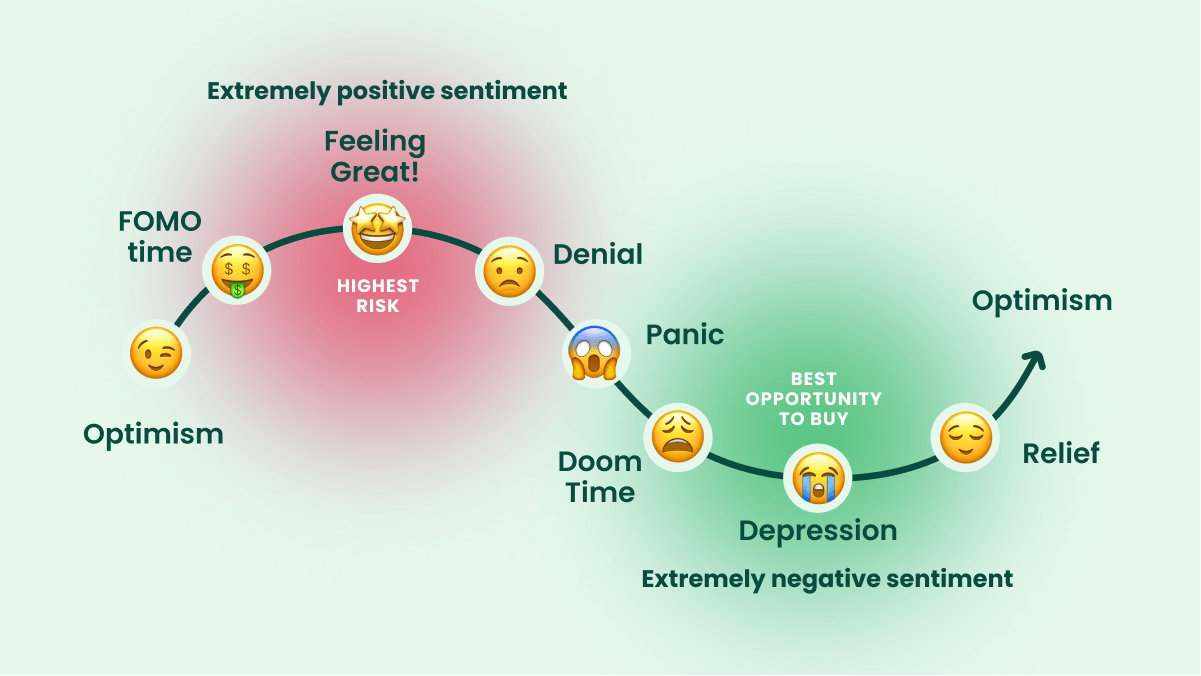

Fear of missing out (FOMO)

We bet every trader is familiar with FOMO. The fear of missing out on a profitable trade is a common psychological problem affecting traders worldwide. Guiding by social media trading influencers, news, and herd instincts, traders become obsessed with the idea of high profits, and this is where panic trading starts. Trading out of FOMO excludes rationality and reasonableness. Traders forget about their trading strategies, risk management plans, and discipline in pursuit of untold wealth. Such chaotic trading leads to inevitable losses and confusion.

Revenge trading

This type of trading is pretty harmful and aggravates a trader's financial position. Let's imagine a trader had a smooth week and was making good stable returns. However, at the end of this week he suddenly lost everything earned and even more. The following reaction is a sense of revenge. Curious to relate, but the revenge is directed at the market. So, the trader seeks to get his funds back as soon as possible and goes wild performing active trading and usually making a number of unforgivable mistakes.

Lack of discipline

A disciplined trader can determine the market's entry and exit points. It is crucial to open and close positions on time. Closing a position is even more complicated. To pull out of the market with a satisfying profit, you shouldn't sit out of the market or go ahead with the schedule, which is problematic.

The lack of discipline causes uncontrolled emotionality. For instance, if the price moves according to the bullish trend, an undisciplined trader is likely to close a position too early when the first downtrend movement happens, which is shaky because it would be more logical to wait for reliable signs of a market reversal and then fix the profit.

As a result, a constant shortage of profit in trading causes significant drawdowns from which it is difficult to recover.

Gambling trading

However, trading is about planning, strict discipline, and constant learning; some traders treat it as gambling. Traders with a gambling mindset don’t consider the trading mechanism in building a proper strategy. They operate unsystematically by a twist of fate driven by adrenaline and excitement to win. Gambling psychology is widespread among both novice traders and professionals who desire to get wealthy without any effort.

Gambling psychology makes traders act impulsively without a well-thought-out plan, which leads to inevitable losses and emotional breakdowns.

Herd instinct

Herd instinct is a significant issue in the field of psychology. In trading, herd instinct is based on the fear of failure. So, traders often rely on crowd decisions instead of comprehensive market analysis. This dependent behavior results in panic trading, unreasonable actions, and losses.

To become a successful trader, you should always work with your psychological side. This simple formula must be a guiding light in your trading journey.

Steps to a winning trading mindset or how to make your profits grow

As you already know, the psychological side of your trading routine is fundamental and inevitable. But how to stay positive under the massive pressure of the decision-making process in terms of unpredictable price fluctuations every day? We’ve prepared a list of advice special for you!

Keep disciplined

Discipline is a vital aspect of our lives, including trading. When you build a well-planned working day, you get self-control and self-management – being disciplined means that you can control your emotions and avoid panic trading. Disciplined traders are more focused and steadily stick to their strategy. They realize the importance of a research stage, physical activity, and the meaning of breaks and mealtimes. These traders are aimed at a long-term trading career and regular profits.

Set trading goals

Goal-setting is an essential part of your career. You should always know what you are working for as a whole and also plan your goals for daily trading. For example, setting risk control, profit, and effort-to-reward ratio goals is important. Goals create a path from reality to perfection. You feel euphoria and success by achieving goals, which is crucial to maintain the eagle spirit and multiplying profits.

Follow your trading plan and strategy

Having a trading plan and trading strategy is key to consistent profitability. A trading plan outlines the markets you want to trade, your trading routine's timeframes, strategies' descriptions, risk management plan, and other essential rules. The trading strategy, in turn, determines the conditions of entering and exiting the market to multiply profit and mitigate the risks.

Track your trading performance

To become a more confident and experienced trader, we highly recommend you have a trading journal where it is comfortable to track your trading performance. With a trading journal, you will be able to reflect on your previous trades and make conclusions about your future trading.

Make a full-fledged analysis of the market

Before hopping into the market, analyze the current market situation and its prospective movements. Conduct comprehensive market examination using tools of technical and fundamental analysis. With the help of market analysis, traders uncover the best opportunities and make informed decisions reducing the probability of panic trading.

Stay flexible

All financial markets never stand still and shift according to the same scenario. Traders must monitor the market transformations and constantly adapt their strategies accordingly. If the market is too volatile, you'd better postpone trading and try to understand the situation. Flexibility means controlling your emotions and being able to assess the situation regardless of your emotions. Stay pragmatic and think critically no matter what happens.

Develop a risk-tolerance

A winning trader is always comfortable with taking risks. Those with low-risk tolerance cannot accept that trades may be loss making; however, such trades are an inevitable part of trading. To become a successful professional, you should accept the uncertainty of the constantly changing market and improve your attitude to the decline in the value of your assets.

Work with your state of mind

Your mental health is the overriding factor. Don’t ignore the mental issues you face. Make an appointment with a therapist, try meditation, art therapy, or do sports to improve your mental condition. Accepting the fact that you can make mistakes and take breaks on time is essential.

Improve your trading knowledge

Knowledge is your superpower. Never stop expanding your trading horizons. Learn about the market-makers, attend trading classes, read news, do your research with chart examinations, and consult with professionals you respect. More you know – the more confident and cool-headed you become.

The importance of maintaining a positive trading psychology

Trading is a forecasting of potential price movements in an attempt to make a profit on these predictive calculations. In each trade, you’re sailing close to the wind because no one can be sure what the future holds, so a trade is always a probable failure.

Learning the simple truth that no human being can predict the future is essential. This philosophical point will help you treat trading easier. Why should we blame ourselves for our failures? All the emotional breakdowns due to the failures create a high barrier to your success, causing burnout and fears before the trading. Do not shift the shade of past failure on your future trading; otherwise, the whole trading will turn into hopeless negativity with a desperate ending.

Trading is a game of numbers where probabilities dictate results. All the other spheres of our life are also unpredictable. As they say, if you want to make God laugh, tell him your plan. Accept the fact of this truth and in case of failure, take it for granted, make conclusions, and enter the game again! Positive thinking and acceptance of simple truths are the keys to a happy and successful life, including a long-term and profitable trading career.

Conclusion

Trading psychology is a fragile thing. Many factors can make traders down, preventing them from regular profits. To become a successful trader with a winning mindset, you should always watch your mental health and control your emotions. Trading discipline, constant learning, sticking to trading plans and strategies, and psychological practices will help you stay positive and grow your funds. Our guides and recommendations will help you improve the psychological aspect of trading. Join us and create your legendary trading path with FBS.